Navigating the intricacies of pay stubs can be a daunting task. However, with our comprehensive “How to Read a Pay Stub Worksheet,” you’ll gain the knowledge and tools to decipher your earnings, deductions, and net pay with ease. This guide empowers you to analyze your pay stubs effectively, ensuring you fully understand your compensation and make informed financial decisions.

Our worksheet provides a structured approach to pay stub analysis, breaking down key components into manageable sections. By following our step-by-step instructions, you’ll be able to identify and calculate various earnings, deductions, and your ultimate net pay. This newfound understanding will empower you to optimize your financial planning and make informed choices about your finances.

Understanding Pay Stub Components: How To Read A Pay Stub Worksheet

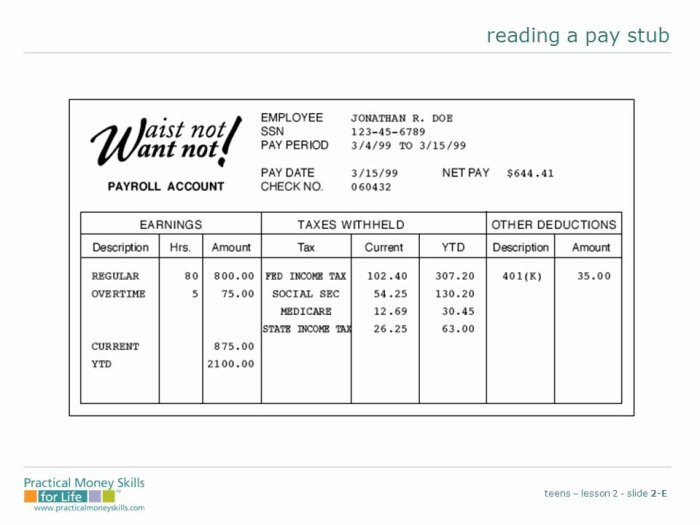

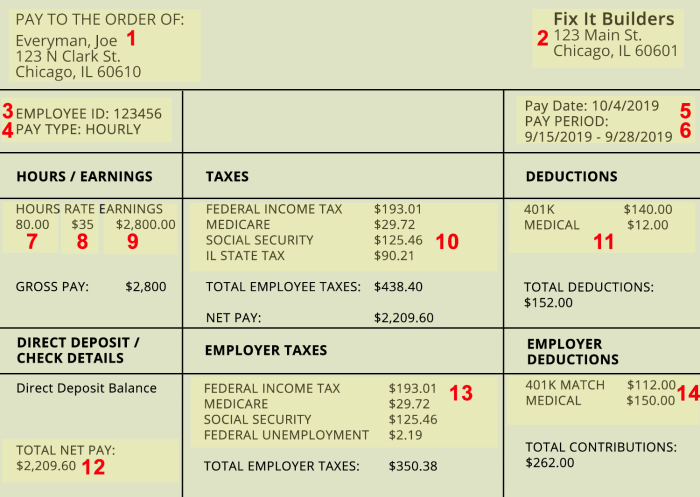

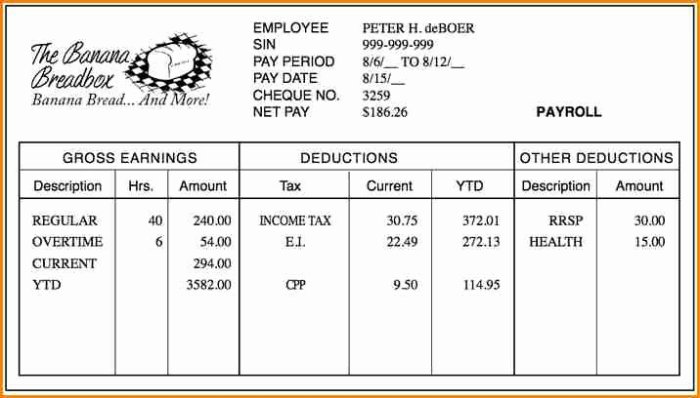

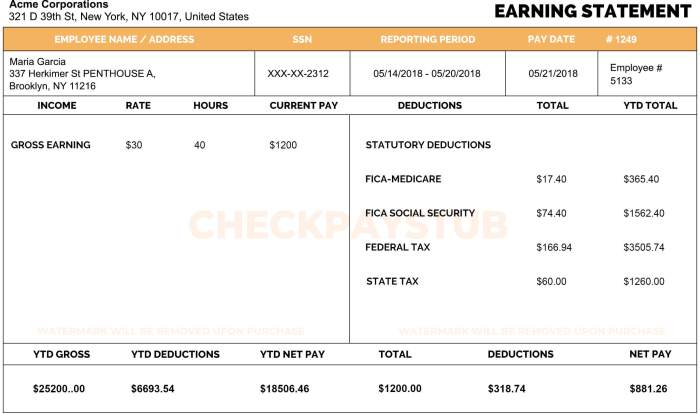

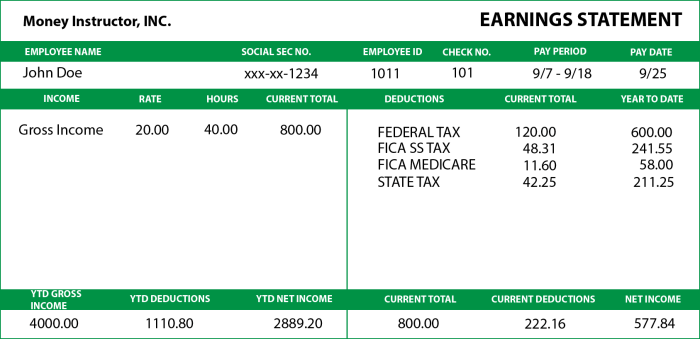

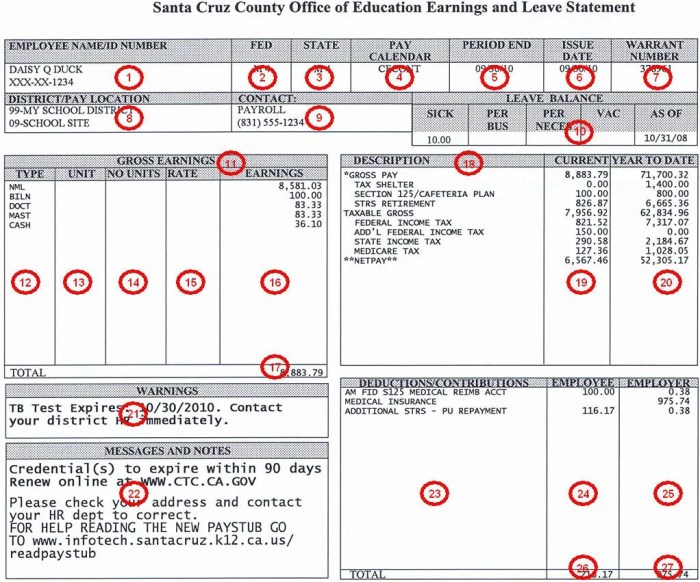

A pay stub, also known as an earnings statement, is a document that provides detailed information about an employee’s earnings and deductions for a specific pay period. It serves as a record of the employee’s compensation and is typically issued by the employer on a regular basis, such as bi-weekly or monthly.

Pay stubs vary in format and layout depending on the company and payroll system used, but they generally include the following essential sections:

Earnings

- Gross Pay:The total amount of earnings before any deductions are taken out.

- Regular Pay:The amount earned for hours worked during the regular workweek.

- Overtime Pay:The amount earned for hours worked beyond the regular workweek.

- Bonuses:Any additional payments received for performance or other reasons.

- Commissions:Payments based on sales or other performance-based incentives.

Deductions

- Federal Income Tax:The amount withheld for federal income taxes.

- State Income Tax:The amount withheld for state income taxes (if applicable).

- Social Security Tax:The amount withheld for Social Security contributions.

- Medicare Tax:The amount withheld for Medicare contributions.

- Health Insurance:The amount deducted for health insurance premiums.

- Retirement Contributions:The amount deducted for retirement savings plans, such as 401(k) or IRA.

Other Information

- Employee Name:The employee’s full name.

- Employee ID:A unique identifier assigned to the employee.

- Pay Period:The dates covered by the pay stub.

- Net Pay:The amount of pay that the employee receives after all deductions have been taken out.

Earnings

Earnings on a pay stub represent the total amount of compensation an employee has earned during a specific pay period. These earnings typically include regular pay, overtime pay, bonuses, and shift differentials.

Regular Pay, How to read a pay stub worksheet

Regular pay refers to the hourly or salaried wage an employee earns for working during their regular work hours. It is typically calculated by multiplying the employee’s hourly rate by the number of hours worked.

Overtime Pay

Overtime pay is paid to employees who work more than the standard number of hours per week, as defined by law or by the employer’s policy. Overtime pay is typically calculated by multiplying the employee’s regular hourly rate by a premium rate, such as 1.5 or 2 times the regular rate.

Bonuses

Bonuses are one-time payments that are awarded to employees for meeting certain performance goals or for special achievements. Bonuses can be based on a percentage of an employee’s salary, a flat amount, or a combination of both.

Shift Differentials

Shift differentials are additional payments made to employees who work outside of the normal daytime hours. These differentials are typically calculated as a percentage of the employee’s regular hourly rate and are intended to compensate employees for working during less desirable hours.

Deductions

Deductions are amounts withheld from an employee’s gross pay for various purposes. Common deductions include taxes, employee benefits contributions, and other voluntary deductions.

Taxes are the most significant deduction from pay. They are levied by federal, state, and local governments to fund public services and programs. The amount of taxes withheld depends on factors such as the employee’s income, filing status, and number of dependents.

Calculating Taxes

Federal income tax is calculated using a progressive tax system, where higher earners pay a higher percentage of their income in taxes. The Internal Revenue Service (IRS) provides tax tables and calculators to help employees estimate their federal income tax liability.

State and local taxes vary depending on the jurisdiction. Some states have no income tax, while others have flat or progressive tax rates. Local taxes may include city or county income taxes or property taxes.

Employee Benefits Contributions

Employee benefits contributions are deductions made from an employee’s pay to fund various benefits, such as health insurance, retirement plans, and paid time off.

The amount of employee benefits contributions is typically determined by the employer and the employee’s enrollment in the benefit plan. Some benefits, such as Social Security and Medicare, are mandatory deductions for all employees.

Other Voluntary Deductions

In addition to taxes and employee benefits contributions, employees may also choose to make voluntary deductions from their pay. These deductions may include contributions to savings plans, charitable organizations, or union dues.

Voluntary deductions are typically made on an after-tax basis, meaning that the employee’s gross pay is reduced by the amount of the deduction before taxes are calculated.

Net Pay

Net pay, also known as take-home pay, represents the amount of money an employee receives after all applicable deductions have been subtracted from their gross earnings. It is the final amount of compensation that an employee can use to cover their expenses and financial obligations.

To calculate net pay, the following formula is used: Net Pay = Gross Earnings- Deductions . Gross earnings include wages, salaries, bonuses, commissions, and any other forms of compensation earned during the pay period. Deductions, on the other hand, are amounts withheld from an employee’s gross earnings for various purposes, such as taxes, insurance premiums, and retirement contributions.

Examples of Net Pay Usage

Net pay is used by employees to cover a wide range of expenses, including:

- Housing costs (rent or mortgage payments)

- Utilities (electricity, gas, water)

- Transportation expenses (car payments, public transportation)

- Food and groceries

- Clothing and personal care

- Entertainment and leisure activities

- Savings and investments

Impact of Deductions on Net Pay

Deductions play a significant role in determining an employee’s net pay. The more deductions an employee has, the lower their net pay will be. Common deductions include:

- Taxes: Federal, state, and local taxes are withheld from employees’ paychecks to fund government programs and services.

- Insurance premiums: Employees may choose to have health insurance, dental insurance, vision insurance, or other types of insurance deducted from their paychecks.

- Retirement contributions: Employees may contribute to 401(k) plans, IRAs, or other retirement accounts through payroll deductions.

- Union dues: Employees who are members of unions may have union dues deducted from their paychecks.

Employees should carefully consider the impact of deductions on their net pay when making financial decisions. By understanding how deductions affect their take-home pay, employees can better manage their finances and plan for the future.

Worksheet for Pay Stub Analysis

A pay stub analysis worksheet is a valuable tool for understanding the various components of a pay stub and tracking financial information over time. It provides a structured way to record and analyze earnings, deductions, and net pay, enabling individuals to gain a comprehensive view of their financial situation.

Worksheet Design

The worksheet should include dedicated sections for the following key components:

- Earnings: This section should include a breakdown of all earnings, such as regular wages, overtime pay, bonuses, and commissions.

- Deductions: This section should list all deductions, including taxes, health insurance premiums, retirement contributions, and union dues.

- Net Pay: This section should display the amount of pay that remains after all deductions have been subtracted from gross earnings.

Worksheet Usage

To use the worksheet, individuals should follow these steps:

- Gather pay stubs for the desired period (e.g., monthly, quarterly, annually).

- Enter the relevant data from each pay stub into the corresponding sections of the worksheet.

- Review the completed worksheet to identify trends, patterns, and areas for potential savings or optimization.

By using a pay stub analysis worksheet, individuals can gain a deeper understanding of their financial situation and make informed decisions about their financial planning.

Using the Worksheet to Analyze Pay Stubs

Using a worksheet to analyze pay stubs provides numerous benefits. It allows for a structured and organized approach to reviewing and understanding pay information. The worksheet helps identify errors or discrepancies, ensures accuracy, and facilitates tax preparation and financial planning.

Step-by-Step Guide to Using the Worksheet

1.

-

-*Gather Pay Stubs

Collect all relevant pay stubs for the period being analyzed.

- 2.

- 3.

- 4.

- 5.

- 6.

- 7.

-*Enter Basic Information

Fill in the worksheet with basic information such as employee name, pay period, and employer details.

-*Record Earnings

List all earnings, including regular wages, overtime pay, bonuses, and commissions.

-*Categorize Deductions

Group deductions into categories such as taxes (federal, state, local), retirement contributions, health insurance premiums, and other voluntary deductions.

-*Calculate Net Pay

Subtract total deductions from total earnings to determine the net pay amount.

-*Identify Errors

Review the worksheet for any discrepancies or errors. Compare pay stub information with employee time records, tax tables, and benefit plans.

-*Document Findings

Note any errors or discrepancies on the worksheet for further investigation or follow-up with the employer.

Identifying Errors or Discrepancies on Pay Stubs

Pay stub analysis can help identify errors or discrepancies, such as:* Incorrect calculation of earnings or deductions

- Missing or inaccurate tax withholding

- Errors in employee information or deductions

- Discrepancies between pay stub and time records

- Omissions of required information, such as overtime pay or paid time off

By carefully reviewing pay stubs and using a worksheet for analysis, individuals can ensure the accuracy of their pay information and protect their financial interests.

Additional Considerations

Understanding pay stubs is crucial for effective financial planning. It provides a comprehensive overview of earnings, deductions, and net pay, enabling individuals to budget, save, and plan for the future.

If necessary, employees can negotiate changes to their pay stubs. This may include adjusting the frequency of payments, altering the amount of deductions, or requesting additional benefits. It is important to approach these negotiations professionally and be prepared to justify the requested changes.

Resources for Further Information

- The U.S. Department of Labor’s Wage and Hour Division provides resources on understanding pay stubs and employee rights.

- The American Payroll Association offers training and certification programs for payroll professionals.

- Online resources such as Paycheck City and ADP provide pay stub calculators and analysis tools.

Helpful Answers

What is a pay stub?

A pay stub is a document provided by employers to employees that details their earnings, deductions, and net pay for a specific pay period.

Why is it important to understand my pay stub?

Understanding your pay stub is crucial for financial planning, ensuring you know how much you earn, what deductions are being made, and how much you take home.

What are the common deductions found on pay stubs?

Common deductions include taxes (federal, state, and local), employee benefits contributions (health insurance, retirement plans), and garnishments.